Real estate depreciation tax deduction calculator

To use this method the following. Section 1245 Depreciation Recapture.

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items.

. The recovery period varies as per the method of computing depreciation. The MACRS Depreciation Calculator uses the following basic formula. 275 year straight line depreciation.

Depreciation Calculator Per the IRS you are allowed an annual tax deduction for the wear and tear of property over the course of time known as Depreciation. This rule states that the depreciation recapture on real estate property is not taxed as ordinary income as long as a straight line depreciation was used over the life of the. Select Property Type Construction Type Quality of Finish Floor Area Estimated year of Construction Year of Purchase and the Closest Major City to your property then click.

Tax depreciation is the depreciation expense claimed by a taxpayer on a tax return to compensate for the loss in the value of the tangible assets used in income-generating. When you buy a rental property you can deduct most of the expenses you incur keeping it up thus lowering your taxable income. What is the depreciation rate for real estate.

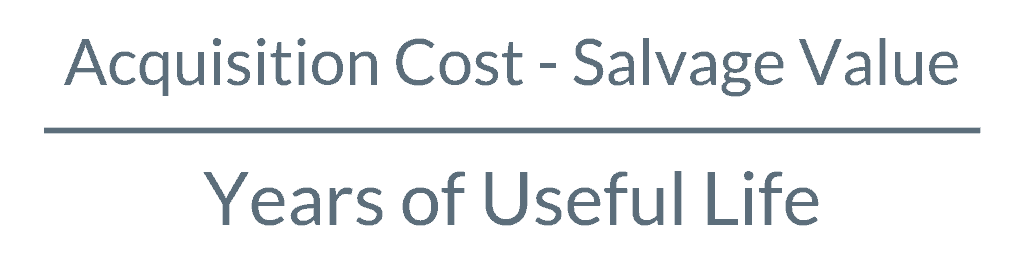

You must own the property not be renting or borrowing. It allows you to figure out the likely tax depreciation deduction on your next investment property. Since you spread the depreciation deduction over 275 years you take the cost basis of the building not the land and divide it by 275 years to calculate your annual.

Even though you get to keep the entire 9600 because of depreciation you only pay. This is the first Calculator to draw on real properties to determine an accurate estimate. Depreciation Calculator Depreciation Calculator Per the IRS you are allowed an annual tax.

The new real estate tax assessment values the property at 90000 of which 81000 is for the house and 9000 is for your land. Section 1245 depreciation recapture is used to calculate any income tax or capital gains tax you may owe on a sold asset. First one can choose the.

Depreciation is based on the value of the building without the land. As a real estate investor. How depreciation can lower your taxes.

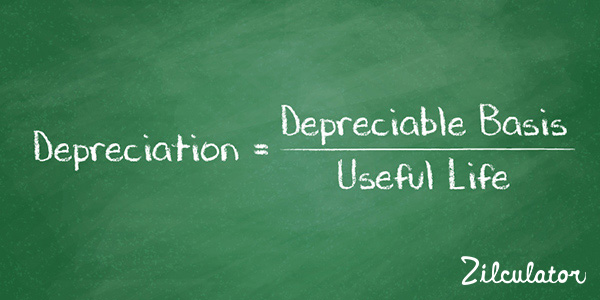

This method of calculating the depreciation of an asset assumes that it depreciates uniformly in value over its effective life. Your tax deduction may be limited with high gross income. It provides a couple different methods of depreciation.

So you must allocate 90 81000. Explore Fawn Creek Township real estate statistics and housing costs. To take a deduction for depreciation on a rental property the property must meet specific criteria.

According to the IRS the depreciation rate is 3636 each year. Depreciation Calculator This depreciation calculator is for calculating the depreciation schedule of an asset. Your depreciation deduction is 8000 calculated as 220000 divided by 275 years.

D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the. To calculate this you will. According to the IRS.

Depreciation Schedule Formula And Calculator Excel Template

How To Calculate Tax Payable On The Sale Of Your Rental Properties

Macrs Depreciation Calculator With Formula Nerd Counter

Real Estate Depreciation Meaning Examples Calculations

How To Depreciate A Rental Property Formula Excel Example Zilculator Real Estate Analysis Marketing

Residential Rental Property Depreciation Calculation Depreciation Guru

Residential Rental Property Depreciation Calculation Depreciation Guru

Free Macrs Depreciation Calculator For Excel

How To Calculate Real Estate Depreciation In The Us Vs Capital Cost Allowance In Canada Excel Youtube

How To Use Rental Property Depreciation To Your Advantage

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

8 Powerful Real Estate Investment Calculators A Full Review

Depreciation Tax Shield Formula And Calculator Excel Template

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Straight Line Depreciation Calculator And Definition Retipster

Straight Line Depreciation Calculator And Definition Retipster

Residential Rental Property Depreciation Calculation Depreciation Guru